Create your own magic with Web 7.0™ / TDW AgenticOS™. Imagine the possibilities.

Copyright © 2026 Michael Herman (Bindloss, Alberta, Canada) – Creative Commons Attribution-ShareAlike 4.0 International Public LicenseWeb 7.0™, TDW AgenticOS™ and Hyperonomy™ are trademarks of the Web 7.0 Foundation. All Rights Reserved.

At the level of human society—not just markets—the real purpose of currency and value exchange isn’t money itself. It’s coordination.

Currency is a social technology that solves a deep, ancient problem:

How do millions of people who don’t know or trust each other still cooperate at scale?

Here’s what that really means.

1. The core function: enabling large-scale cooperation

Before money, exchange depended on:

- Barter (which rarely matches needs),

- Reputation inside small tribes,

- Or coercion.

Currency replaces all three with something more powerful:

a shared belief system that lets strangers coordinate effort, resources, and time.

At a societal level, money allows:

- A farmer to feed a software engineer,

- A nurse to support a miner,

- A poet to live in a city built by people they’ll never meet.

Not because they trust each other — but because they trust the system of exchange.

So the real purpose is:

To turn individual labor into collective civilization.

2. Value exchange is how society answers one question

“What matters enough that we will allocate our lives to it?”

Every society must constantly decide:

- What gets built?

- Who gets rewarded?

- What work is considered worthy?

- What future we are steering toward?

Currency is the mechanism that turns those abstract choices into concrete incentives.

Money doesn’t just move goods.

It moves human attention, time, and creativity.

Where value flows, society flows.

3. Money is not wealth — it’s a memory system

At a deep level, currency is a distributed memory of contribution.

It records:

- Who gave value to society,

- In what amount,

- And stores the right to claim value later.

In this sense, money is society’s way of saying:

“You helped before. You can draw from us now.”

That’s why when currencies collapse, societies don’t just lose purchasing power — they lose trust, continuity, and social coherence.

4. The moral dimension: money as a proxy for meaning

In healthy societies, value exchange roughly tracks:

- Contribution,

- Skill,

- Effort,

- Risk,

- Social benefit.

In unhealthy societies, it drifts toward:

- Power,

- Rent-seeking,

- Manipulation,

- Extraction.

So at a civilizational level, currency is also a moral instrument.

Not because money is moral — but because what it rewards defines what a society becomes.

Tell me what a society pays for, and I’ll tell you what it worships.

5. The deepest purpose: reducing violence

Before reliable exchange systems:

- Resources were taken by force.

- Status was enforced through dominance.

- Survival meant conflict.

Currency allows societies to replace coercion with consent.

Instead of:

“I take what I need.”

We get:

“I earn what I need by giving value.”

This is one of humanity’s greatest civilizational upgrades.

Money is, in a very real sense,

a technology for peace.

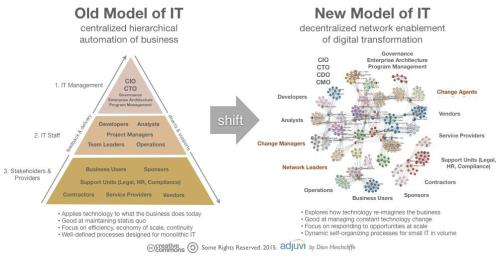

6. Where this is heading

As societies evolve, the purpose of value exchange is shifting again:

- From tracking labor → tracking impact.

- From rewarding extraction → rewarding regeneration.

- From scarce tokens → to trusted coordination systems (reputation, data, access, participation).

Currency is slowly becoming less about money

and more about governance of attention, trust, and collective direction.

In one sentence

At the level of human society, the real purpose of currency and value exchange is:

To transform individual effort into collective civilization by enabling trust, cooperation, and coordinated meaning at scale.